📊 Comparative Report: India’s Service Exports vs Saudi Arabia’s Oil Exports

1. Overview

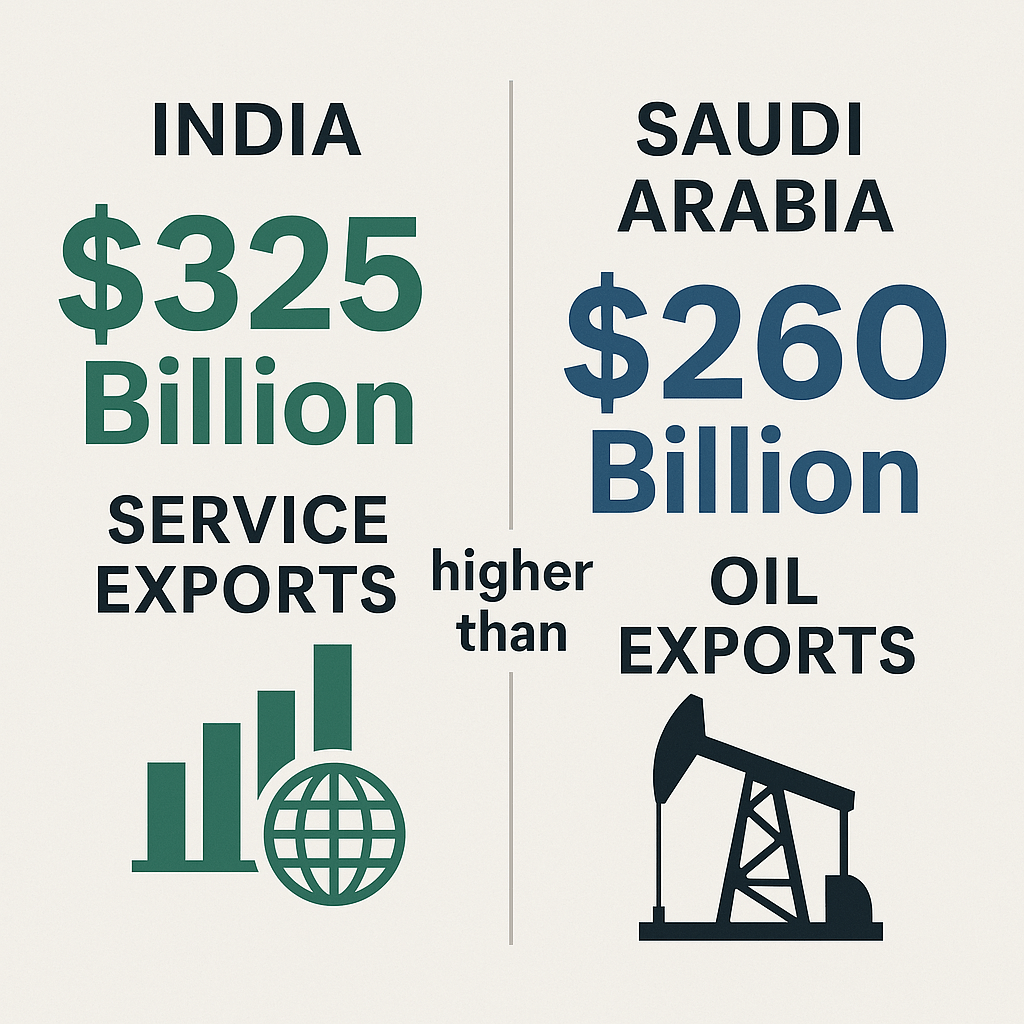

In a major shift in global trade dynamics, India’s service exports have surged to approximately $325 billion (FY2024), surpassing Saudi Arabia’s total oil exports which stand at around $260 billion. This comparison is symbolic of changing economic strengths, showcasing India’s rise as a knowledge and technology-driven economy and highlighting Saudi Arabia’s dependence on hydrocarbon resources.

2. India’s Service Export Growth

📈 Key Figures:

- FY2023–24 (Est.): $325 billion (source: Ministry of Commerce, India)

- Growth Rate: ~10–12% YoY

- Share of GDP: ~10%

- Global Rank: Among the top 7 service exporters globally

🧠 Major Contributors:

| Sector | Approx. Contribution |

|---|---|

| IT and ITeS | $180–200 billion |

| Business & Professional Services | $35–40 billion |

| Financial Services | $20–25 billion |

| Travel & Tourism | $15–18 billion |

| Transportation & Logistics | $10–15 billion |

| R&D and Engineering Services | $8–10 billion |

🛠 Key Drivers:

- Global demand for IT outsourcing and digital transformation

- Rise of Software-as-a-Service (SaaS) firms and start-up ecosystem

- Competitive advantage in English-speaking, skilled labor

- Growth of fintech, consulting, and analytics sectors

3. Saudi Arabia’s Oil Exports

🛢 Key Figures:

- 2023 Total Oil Exports: ~$260 billion (source: OPEC, Saudi Aramco, IMF)

- Volume: ~7 million barrels per day (net exports)

- Dependence on Oil Revenue: >70% of total export revenue

📉 Challenges:

- Oil price volatility: Brent crude averaged ~$82/barrel in 2023, compared to >$100/barrel in 2022.

- OPEC+ Production Cuts: Reduced overall volumes

- Global Energy Transition: Shift toward renewables and EVs

- Domestic Reforms: Vision 2030 seeks diversification, reducing over-reliance on oil

4. Economic & Geopolitical Significance

| Factor | India | Saudi Arabia |

|---|---|---|

| Economic Model | Service-led, diversified | Oil-based, in transition |

| Long-term Growth | Sustainable with high innovation potential | Vulnerable to global energy shifts |

| Geopolitical Leverage | Soft power through IT & diplomacy | Hard power through energy exports |

| Strategic Shift | Digital economy, AI, cloud, fintech | Tourism, infrastructure (Neom, Vision 2030) |

5. Implications & Outlook

🌏 For Global Economy:

- Shift in global trade balance toward digital and knowledge economies

- Growing south-south trade led by service economies (India, ASEAN, Africa)

- Services less prone to climate or geopolitical shocks than commodities

🇮🇳 For India:

- Services now outperforming goods in export growth

- Strengthens INR stability and foreign exchange reserves

- Opportunity to lead in AI, cybersecurity, biotech, etc.

🇸🇦 For Saudi Arabia:

- Increased urgency for economic diversification

- Strategic investments in non-oil sectors, e.g., tourism, sports, AI

- Oil still key for short-term cash flows and fiscal health

6. Conclusion

India’s $325 billion service export achievement marks a strategic inflection point — a transition from a back-office outsourcing hub to a global powerhouse in high-value services. In contrast, while Saudi Arabia’s oil remains a potent global commodity, the world’s pivot toward digitization and sustainability gives countries like India a unique opportunity to lead the future economy.

7. Visual Comparison (Summary Table)

| Metric | India (Services) | Saudi Arabia (Oil) |

|---|---|---|

| 2023–24 Export Value | $325 billion | $260 billion |

| Growth Trend | Upward | Volatile/Declining |

| Diversification | High | Low (but improving) |

| Long-term Stability | High | Medium to Low |

| Strategic Advantage | Tech, Talent | Energy, Geography |

Curated by Gurdeep Singh, Senior Editor

Leave a comment