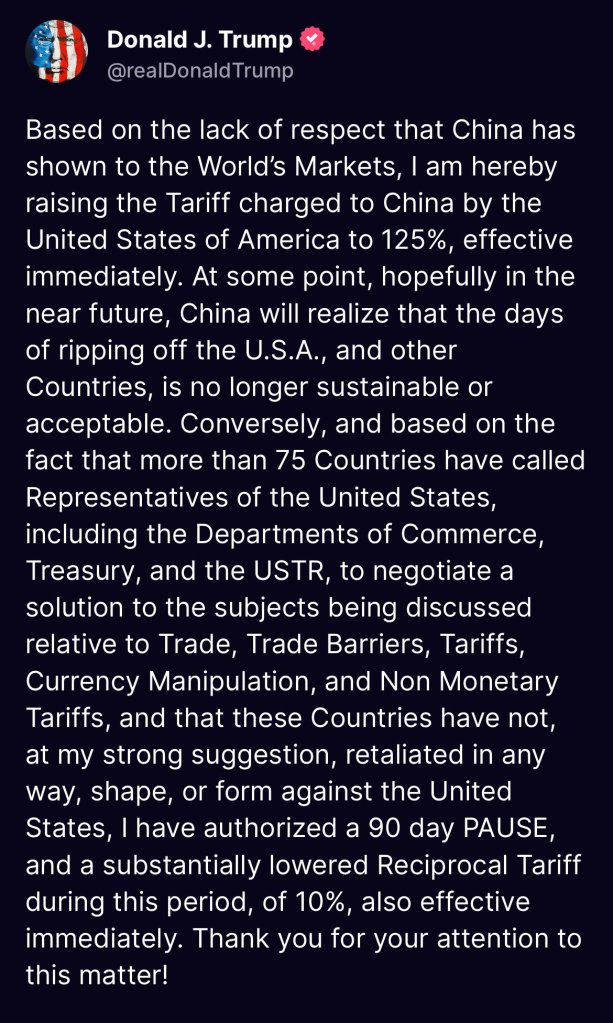

In a dramatic shift in U.S. trade policy, former President Donald Trump on April 9, 2025, announced a 90-day pause on increased tariffs for over 75 countries while simultaneously imposing a hefty 125% tariff on Chinese imports. The move has drawn widespread global attention and is already impacting financial markets and international relations.

Temporary Relief for Over 75 Countries

The 90-day pause comes after an influx of requests from various nations seeking time to engage in negotiations with the United States regarding new trade terms. During this period, a universal tariff of 10% will be applied to exports from these countries.

Trump described the decision as a “gesture of goodwill” towards allies and partners that have shown a willingness to reengage under revised trade terms. The pause is intended to facilitate fair trade discussions while maintaining leverage through a baseline tariff.

Tariff Hammer Falls on China

In stark contrast, the administration has more than doubled tariffs on goods imported from China, raising the rate to an aggressive 125%. This move, according to Trump, was necessary to confront “ongoing abuse” and “lack of respect” in trade practices by the Chinese government.

Trump emphasized that China had failed to honor previous agreements and continued to exploit American markets with what he labeled “predatory pricing and manipulation.”

Market Responds with Volatility and Gains

The U.S. stock market responded swiftly and positively to the announcement. The Dow Jones Industrial Average skyrocketed by over 2,200 points—an increase of nearly 6%—closing at a record high of 39,916.64. Investors interpreted the pause in tariffs as a sign of temporary stability, while the aggressive stance toward China was seen as a firm commitment to protecting U.S. industry.

China Hits Back

In response to the new tariff regime, China retaliated by levying a steep 84% tariff on American goods, particularly targeting agricultural products and high-tech equipment. The Chinese government warned of further retaliatory steps if the situation escalated.

Analysts now warn that the growing tit-for-tat exchange could reignite a full-blown trade war between the world’s two largest economies.

U.S. Officials Justify the Strategy

U.S. Treasury Secretary Scott Bessent defended the administration’s decision, stating that the 90-day pause allows for fair negotiation with countries that act in good faith, while the hike on China reflects the need to confront “long-standing structural imbalances.”

He added that the administration would continue monitoring all international trade partners and make further adjustments as needed.

Strategic and Political Implications

This dual-action policy reflects Trump’s hallmark “America First” doctrine—blending diplomacy with confrontation. The selective application of tariffs allows the U.S. to keep strategic partners engaged while delivering a clear warning to China and others deemed to be acting against U.S. interests.

With the 2024 presidential campaign behind him and international attention intensifying, Trump’s trade strategy appears aimed at reshaping global economic relationships to favor U.S. manufacturing, exports, and security.

Curated by Gurdeep Singh, Senior Editor at BoldVoices

Leave a comment