Definition

VWAP, or Volume Weighted Average Price, is a trading indicator that calculates the average price of a security, weighted by the volume of trades at each price level. It is commonly used by traders to measure the average price a stock has traded at throughout the day, based on both price and volume.

Calculation

The VWAP is computed using the following formula:

[

\text{VWAP} = \frac{\sum (\text{Price} \times \text{Volume})}{\sum \text{Volume}}

]

Where:

- Price refers to the trade price of the security.

- Volume refers to the number of shares traded at that price.

Steps to Calculate VWAP:

- For each period (e.g., minute, hour, etc.), calculate the typical price:

[

\text{Typical Price} = \frac{(\text{High} + \text{Low} + \text{Close})}{3}

] - Compute the cumulative total of the typical price multiplied by volume (Cumulative TP × Volume).

- Compute the cumulative total of volume.

- Divide the cumulative total of the typical price times volume by the cumulative total of volume to obtain the VWAP.

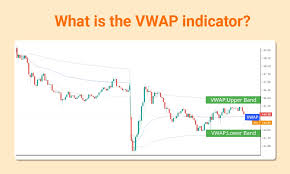

Interpretation

- Price above VWAP: Indicates bullish sentiment or that the asset is being traded at a higher price relative to its average.

- Price below VWAP: Indicates bearish sentiment or that the asset is being traded at a lower price relative to its average.

- Crossing VWAP: Traders may look for potential trading signals when the price crosses the VWAP line:

- Bullish signal when the price crosses above.

- Bearish signal when it crosses below.

Usage in Trading

- Trend Confirmation: Traders often use VWAP in conjunction with other indicators to confirm market trends.

- Entry and Exit Points: VWAP can act as support or resistance levels, providing potential entry or exit points.

- Order Placement: Many institutional traders use VWAP to execute trades without impacting the market too heavily, aiming to buy below VWAP and sell above it.

Limitations

- Time Frame Dependency: VWAP resets at the beginning of each trading day, which means it does not provide historical data for multi-day trends.

- Delayed Signal: VWAP is a lagging indicator and may not predict sudden price movements.

Conclusion

The VWAP is a vital tool for traders seeking to understand price trends and volume dynamics. Its weighted average provides a more nuanced view of price activity and helps traders make more informed decisions.

Leave a comment