The Volume Indicator is a critical tool used in technical analysis to assess the level of trading activity for a particular asset over a designated period. Understanding volume can provide insights into the strength or weakness of a price trend and help traders make informed decisions. Below are the complete details regarding the Volume Indicator.

What is Volume?

Volume, in trading, refers to the total quantity of shares or contracts traded in a security or market during a given period. It serves as a measure of the activity level of a specific market or security.

Importance of Volume Indicator

- Liquidity Assessment: Higher volume typically indicates greater liquidity, which can lead to more efficient price moves and reduced slippage.

- Trend Confirmation: Volume can be used to confirm the validity of a price trend. For instance, a price increase accompanied by high volume suggests strong buying interest, while a price rise on low volume may indicate a weak trend.

- Market Sentiment: Shifts in volume can provide insights into market sentiment. Increasing volume may suggest that more traders are entering the market, while decreasing volume might imply a lack of interest.

- Identifying Reversals: Sudden spikes in volume often precede major price reversals, providing traders with early signals to adjust their positions.

Types of Volume Indicators

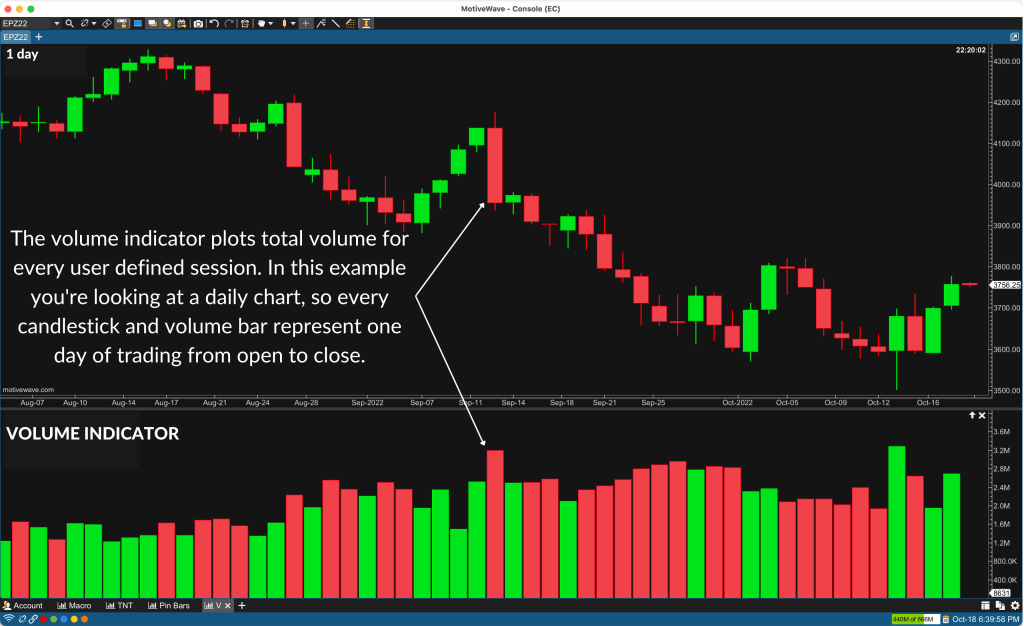

- Simple Volume: The basic measure of total trading volume over a specified time frame.

- Volume Moving Average: This indicates average volume over a set period, helping to smooth out spikes and falls over time.

- Volume Oscillator: This tool compares two volume moving averages to measure the difference. A rising oscillator might indicate increasing buying strength.

- On-Balance Volume (OBV): A cumulative indicator that adds volume on days when the price increases and subtracts it on days when the price decreases. This helps in assessing the direction of the flow of money.

- Accumulation/Distribution Line: Combines price and volume to evaluate whether a security is being accumulated (bought) or distributed (sold).

How to Use the Volume Indicator

- Entering Positions: Traders often look for high volume as a confirmation to enter a trade, particularly when aligned with other indicators or chart patterns.

- Setting Stop Loss: Monitoring volume can help determine optimal stop-loss levels. Low volume can signify potential reversal areas.

- Exiting Trades: If a price move occurs with decreasing volume, traders may choose to exit their positions, expecting potential retracements.

Conclusion

The Volume Indicator is an invaluable tool for traders. It not only measures market activity but also assists in confirming trends and identifying potential reversals. Incorporating it into a broader trading strategy can help traders enhance their decision-making process and improve overall trading performance.

Leave a comment