What is a Moving Average?

A Moving Average (MA) is a statistical calculation that analyzes data points by creating averages of different subsets of the complete data set. In finance and trading, moving averages are primarily used to smooth out price data and identify trends over time.

Types of Moving Averages

- Simple Moving Average (SMA):

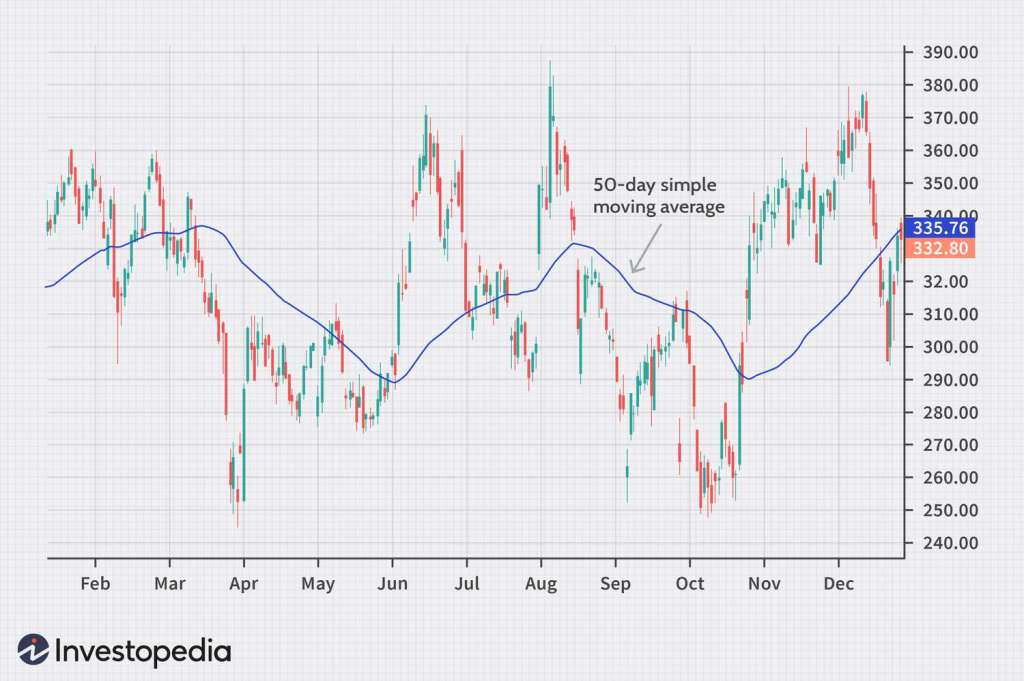

- The SMA is calculated by adding the closing prices of a security over a specific period and then dividing by the number of periods. It provides a smooth, consistent line on the price chart.

Formula:

[

SMA = \frac{(P_1 + P_2 + … + P_n)}{n}

]

Where (P) represents the price, and (n) is the number of periods. - Exponential Moving Average (EMA):

- The EMA gives more weight to the most recent prices, making it more responsive to new information. This is preferred by traders who need to respond quickly to price changes.

Formula:

[

EMA = (C_t \times \alpha) + (EMA_{yesterday} \times (1 – \alpha))

]

Where (C_t) is the current closing price, and (\alpha) is the smoothing factor, calculated as (\frac{2}{n + 1}). - Weighted Moving Average (WMA):

- The WMA assigns weights to each data point, with more recent data being more significant. This type can be beneficial in various trading strategies.

Formula:

[

WMA = \frac{\sum_{i=1}^n (P_i \times W_i)}{\sum_{i=1}^n W_i}

]

Where (W) represents the weights assigned to each price.

Applications of Moving Averages

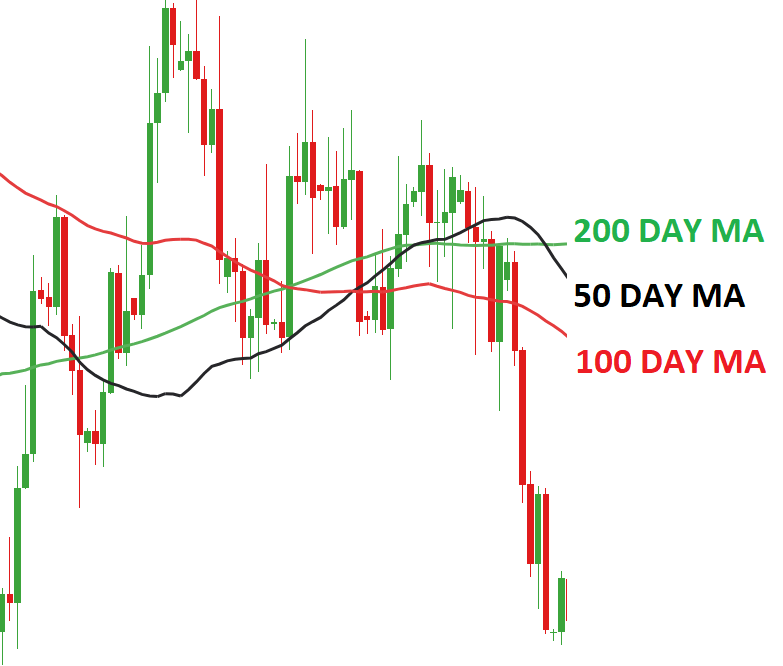

- Trend Identification: Moving averages help identify the direction of the trend. If the price is above the moving average, it indicates a bullish trend; if it’s below, it indicates a bearish trend.

- Support and Resistance Levels: Moving averages can act as dynamic support and resistance levels, often leading to price rebounds or breakouts.

- Crossover Signals: Traders often use crossovers between short-term and long-term moving averages (e.g., when a short-term MA crosses above a long-term MA, it generates a buy signal, and vice versa).

Key Points to Consider

- Period Selection: The choice of period (e.g., 50-day, 200-day) affects the sensitivity of the moving average. Shorter periods can produce more signals, while longer periods provide fewer signals but higher accuracy.

- Lagging Indicator: Moving averages are lagging indicators, meaning they react to past price movements and may lead to delayed signals.

- Combining with Other Indicators: Using moving averages in conjunction with other technical indicators (like RSI, MACD) can improve the effectiveness of trading strategies.

Conclusion

Moving averages are fundamental tools in technical analysis that assist traders in evaluating historical and current price movements. By understanding the various types and applications, traders can make more informed decisions in their trading strategies.

Leave a comment